In order to receive a Tax Registration Number ( TRN), the UAE CT Law mandates that all Taxable Persons and specific types of Exempt Persons ( such as Qualifying Public Benefit entities and Qualifying Investment Funds) register for Corporate Tax ( CT) with the Fedral Tax Authority (FTA)

The deadlines for seeking for exemption for specific categories of Exempt Persons under the UAE CT Law and for acquiring CT registration were previously outlined in Decision No. 7 of 2023, which was issued by FTA.

The Cabinet Decision No. 75 of 2023 (now Cabinet Decision No. 10 of 2024) was amended to specify the administrative penalty in the event that the deadlines are not met. The FTA also issued Decision No. 3 of 2024, which sets forth the timelines for filing an application for CT registration in the case of all Taxable Persons under the UAE CT Law.

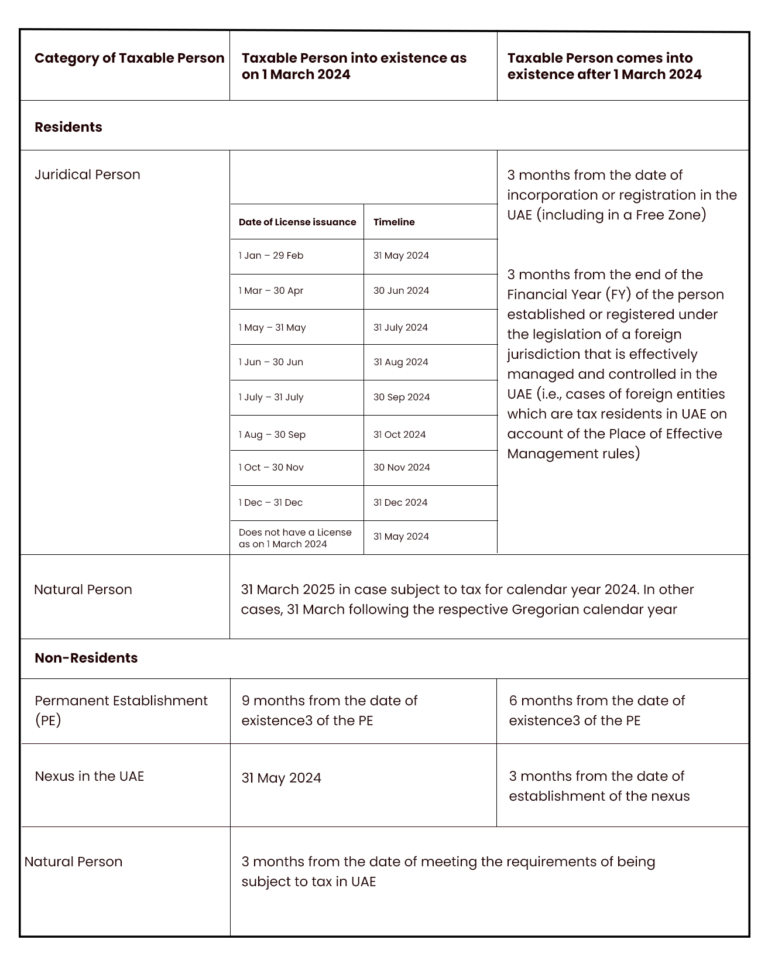

Dates For Submitting The Application For CT Registration

1: Regardless of the year of issuance, the Taxable Resident Person shall refer to the date of licence issuance.

When a resident legal person possesses multiple licences (such as an LLC in the United Arab Emirates with a branch in the country or an LLC with distinct trade and service licences), the licence with the earliest issuing date will be taken into account when calculating the timeline.

2: According to Ministerial Decision No. 43 of 2023, Non-Resident Persons who simply receive income from the state and do not have a PE or connection to the UAE are exempt from registering for UAE CT.

3: t’s unclear at this time how the PE’s “date of existence” must be ascertained. For instance, in a Fixed Place PE, the question of whether the start of PE-related activities or the crossing of the 6-month threshold counts as a relevant date should be considered.

4: As per Cabinet Decision No. 56 of 2023, a non-resident person residing in the UAE has a connection to the country if they receive income from any immovable property there.

5: Only when the total turnover from such business or business activities surpasses AED 1 million in a Gregorian calendar year would a natural person doing business or business activities be obliged to register for UAE CT.

Administrative Fine:

If a CT registration application is not submitted by the deadline, there will be an administrative penalty of AED 10,000.

Important Lessons Learned:

The FTA Decision has now clarified the advice given in the UAE CT regime FAQs regarding registering for UAE CT prior to filing the first CT return. Please take note that this deadline pertains to submitting the registration application only, not to receiving the registration number.

Before submitting the registration application, taxpayers must ensure that a valid licence has been uploaded and accepted on the EmaraTax (FTA) portal.

Although this does not appear to be the intention, there might be a scenario in which the deadline for filing a CT registration application is 31 March 2024 (i.e. nine months from 1 July 2023) for a non-resident juridical person that is as of 1 March 2024 and has followed a July–June fiscal year.

The deadline for tax group registration remains unchanged.

Next Actions:

To prevent non-compliance and potential penalties, all Taxable Persons must determine when to submit their CT registration application. When determining the applicable due date, resident juridical persons with numerous enterprises or licences must consult the licence with the earliest issuance date.

All users can now access the EmaraTax (FTA) portal to receive CT registration.

A specialised staff at SS&CO can assist your company with registering for CT in the UAE